Hello again, new and old readers alike! It’s time for another installment of my weekly FAQ Answer blogs, where I answer the most burning questions I get from my customers. We’re still focusing on first-time homebuyers at the moment – if you missed last week’s post on how to qualify for a mortgage, and you want to know more about that before you dig into this week’s topic, by all means click the link – this post will still be right here when you get back, to give an answer to another, equally important question: “How much house can I afford?”

One of the most frequently asked questions I get when buyers come to see me is, “How much can I afford?” Beginning the process to answer that question is a tricky one, but it’s basically going to depend on one thing more than anything else: how much you can afford as a monthly payment.

If you go to see a mortgage lender, this is what they’re going to ask you first. They can help you tweak it based on other variables after, but it really helps to go in with a ballpark number first, so that you have some kind of starting point.

Calculating Your Budget

If you remember from two weeks ago, in the first post about mortgages, your mortgage goes in your budget where the rent on your house or apartment used to go. Roughly, that should take up about a third of your budget – somewhere around 33%.

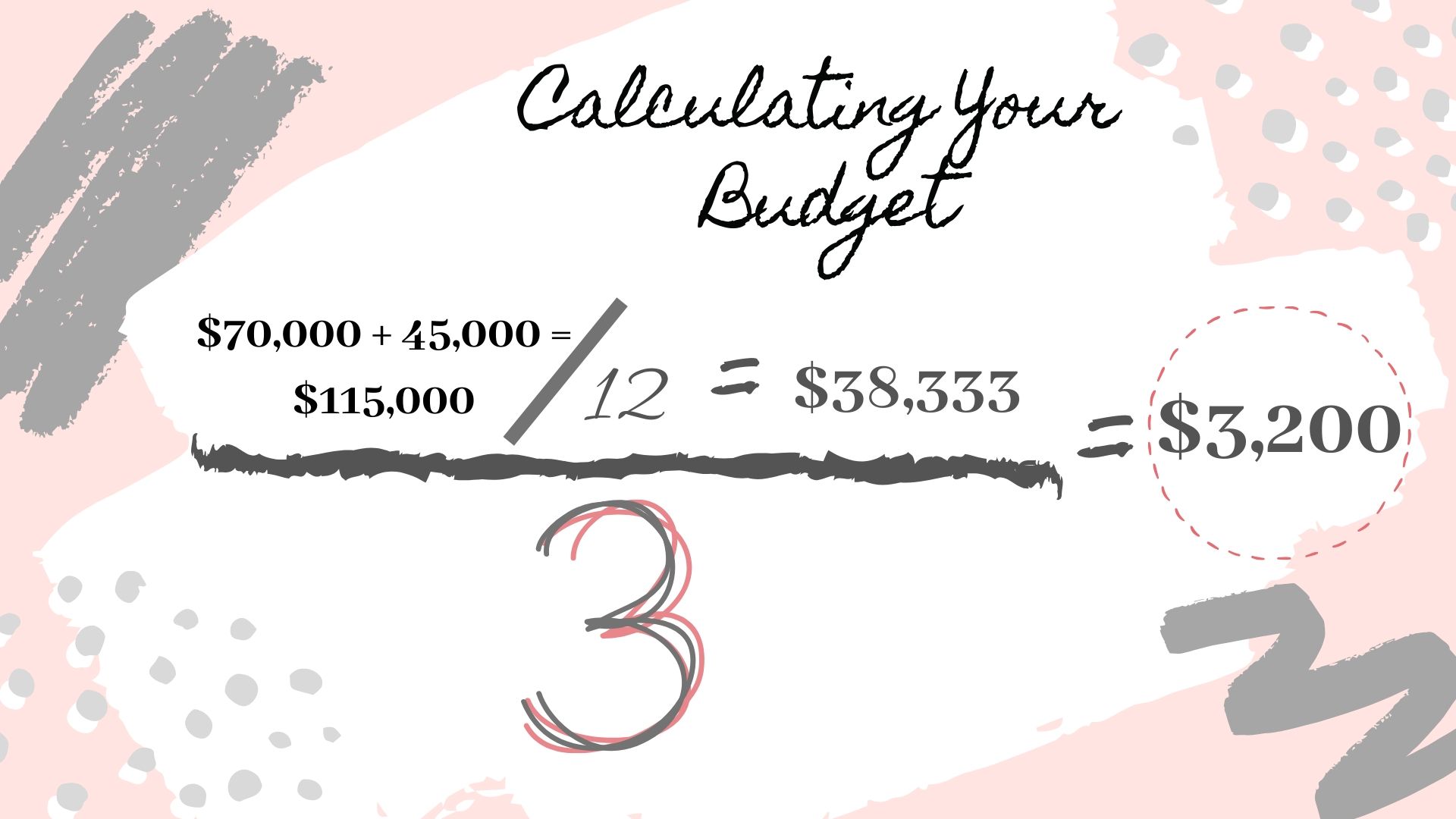

So, let’s say for the example’s sake you’re a two-income household. One of you makes $70,000 a year while the other makes $45,000 a year (after taxes). Your budget should therefore be around a third of $115,000, which comes out to a little over $38,333. That’s somewhere around $3,200 a month.

Now, obviously, in real life this calculation would be a bit less cut-and dry – taxes tend to do that to a clean, even salary. This example is merely here to show you how the calculations should work. Additionally, if you don’t earn an even salary every month – for example, if you’re a freelancer – you may want to do this calculation based on your average gross monthly budget. You can save yourself a little more math that way.

Other Questions

Now, what makes this trickier than just calculating rent is the fact that this is, in fact, a mortgage. So, as we explained last week and the week before, there are a few other factors at play here, like interest payments, adjustable rates, closing costs, et cetera.

This is where your mortgage lender can help you. First, your lender will look at your income and your assets, to determine that the budget you came in with is a sustainable starting point. Then, they might ask a few more detailed questions about your finances, to get a better picture of where you might be headed.

Salary: Present and Future

One such question is whether you are in a job that is going to be increasing your salary, versus a job where your salary is perhaps more stagnant, or you are uncertain if you will get steady raises or promotions.

If you know for a fact that you are going to get steady raises in your career over the years, then your lender will probably tell you that you have a bigger budget than you thought, since you’ll be able to afford larger payments later on in life. If you’re not sure about your salary advancing, or you think you may be making a career change or one spouse may be staying home in the future, it’s safer to look at the budget in terms of those possible changes – perhaps being a little more cautious in setting your budget.

Your Goals

Another thing your lender will also look at is your goals. When people buy a house, it’s not always with the goal of finding a forever home. You might know you’re only going to be in this house for two to three years, perhaps because you are relocating to the area and know you’re going to move again, or maybe because you don’t want to buy a larger home until you need the space for a growing family. In that case, it may not make sense for you to get a 30-year, fixed-rate mortgage: It would be better if to get a one or three year ARM, which is a lower rate than the 30-year fixed rate option, and will therefore save you money.

If you are buying a house that you want to be in for a long time, possibly your Forever Home, and your income is rising reliably, then your lender probably will stretch your budget to a point (though still one that you can afford). Even if the budget feels tight at first, it will only be for a little while: As your salary grows, your mortgage will begin to feel more and more comfortable. And with a 30-year mortgage, you’ll be able to afford it. You probably also want the 30-year fixed-rate in that case, since you can make those payments over the time you own your home, and lock in what is, at the moment, an exceptional rate.

In Conclusion…

So there are a lot of variables to go into play here, but again, a really easy way to do it is to calculate around 33% of your income to figure out your payments. 38% is actually going to be closer to your total debt load, as you may remember from when we discussed DTI, but I would highly recommend that you talk to a mortgage lender about that more, because, as we’ve been seeing, there’s so much more that goes into it besides just those simple fractions.

If you don’t have a mortgage lender yet, your realtor can give you some good options for people they know that work in the area, people who are familiar with your location. Your mortgage lender can guide you based not only on your income and cash available, but also your goals.

And, if you don’t have a realtor yet, and you live or are looking to live somewhere in Suburban Philadelphia, please reach out and give me a call or send an email! I’ll be happy to meet with you and discuss your goals and options, whether you’re looking for something temporary, a starter house, or your forever home.