As a realtor, I get tons of questions from new homebuyers. Questions like, “What is a mortgage?” “How do I know when to buy?” and “What is the right neighborhood for me?” come up all the time, and since buying a home can be such a confusing and stressful process, I want to help first-time homebuyers in any way I can.

One of the best ways I know to do that is by helping them to understand the homebuying process before they get into it. Reading up beforehand can make the whole thing worlds easier and less stressful, so I’m going to create a new series of blog posts answering some of my most frequently asked questions from new homebuyers.

The first of those questions is, simply, what is a mortgage?

What is a mortgage?

Before you buy a home, it’s important to know how a mortgage works. Most people know that a mortgage is a loan, and it’s how you pay for your house, but before you actually get into it yourself, you may not fully understand exactly what it means when people refer to a “mortgage.”

In your budget, your mortgage goes where the rent on your house or apartment used to. Some people might say that the bank owns your house until you pay off your loan, but that’s not technically true. You own your home, as the deed is in your name. Your home is simply used as collateral against the loan you took out to pay for it. This means that if you miss a payment on the loan, the bank can take your home and sell it in order to get the money that you owe them. (That’s what foreclosure is.)

By definition, any loan you take out using your home as collateral is a mortgage.

What are the different types of mortgages?

There are a few different kinds of mortgages, but what you normally get are two options: Fixed or adjustable rate, and short term or long term.

Fixed Rate vs. Adustable Rate

A fixed-rate mortgage is one where the interest rate is set when you originally take out the loan, and will not change over time. This means you’ll have stability in the mortgage payments you make, so it will look more like the monthly rent you’re probably used to, into the foreseeable future.

An adjustable rate mortgage, commonly referred to as an ARM, is a bit more complex to understand. These mortgages are tied to what is known as an index and a margin.

The index is a measure of international interest rates, and is what makes the ARM adjustable. Depending on things like the state of the economy and what the Federal Reserve rates are, your payment could go up or down.

The margin is the number of percentage points added to the interest rate by the lender at the time the loan is taken out—this is how your lender can ensure they will make money on the loan. This is also the part you may be able to negotiate or shop around for, so if you decide to go with an ARM, be sure to pay close attention to the margin.

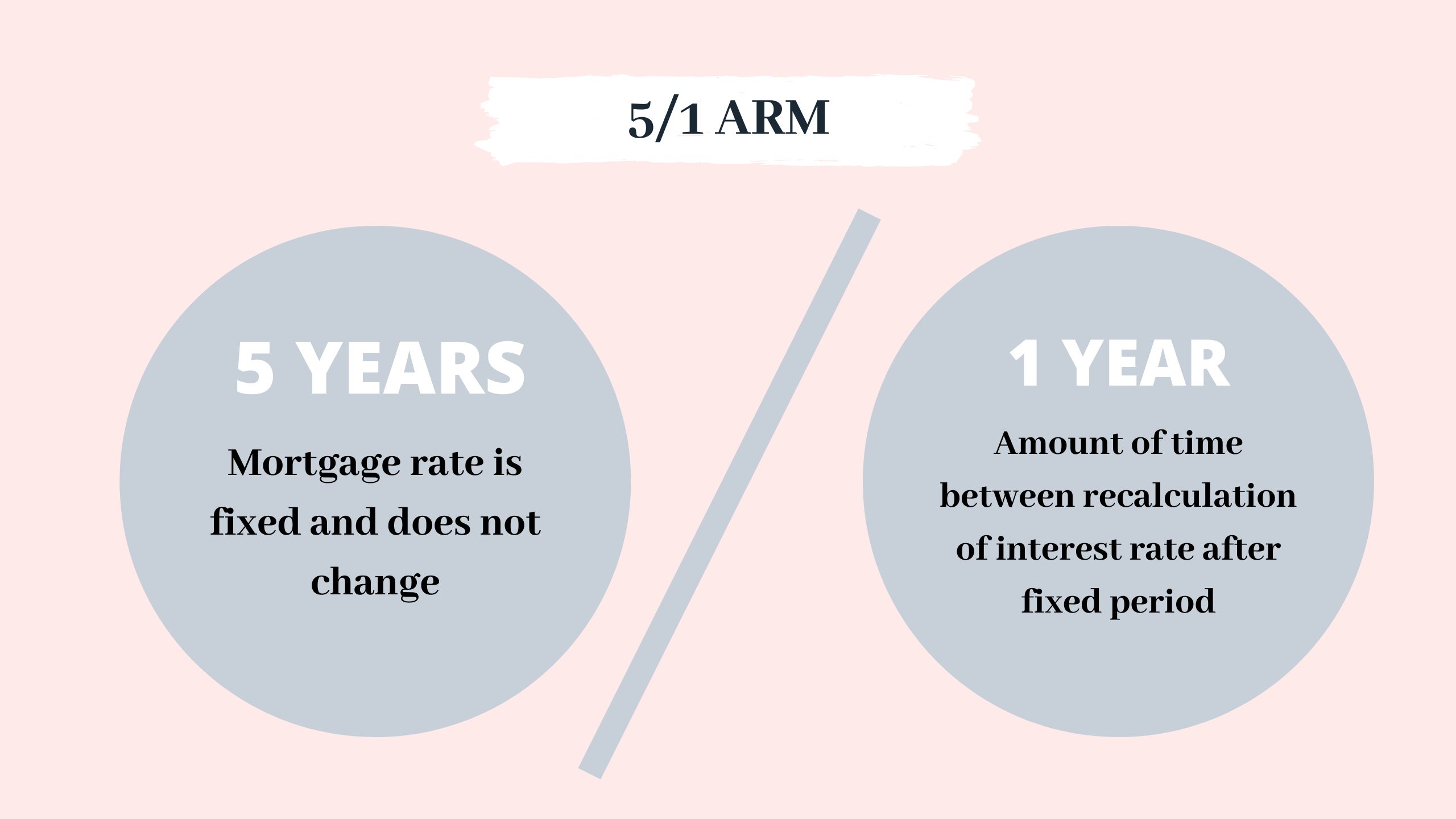

When you sign up for an ARM, you select an initial fixed period, and a rate for how often your mortgage can change after. For example, if you have a 5/1 ARM, it means your interest rate is fixed for the first five years, and then after that it can be recalculated once every year to account for changes in the index.

There are advantages and disadvantages to both of these.

With fixed, you know what you’re getting, while adjustable is a bit more of a gamble; the rates could drop significantly, but they could also go up. However, ARMs often have much lower interest rates for the initial fixed period, so you’re often guaranteed to save a lot of money during the early years of your mortgage.

Of course, all of this also depends on how the housing market is doing. Right now, interest rates are low, so a lot of people are choosing to go with a fixed rate mortgage, to lock in those low rates. You can talk to your realtor, your lender, a financial advisor, or all of the above, to help you determine which decision is best for you.

Short Term vs. Long Term

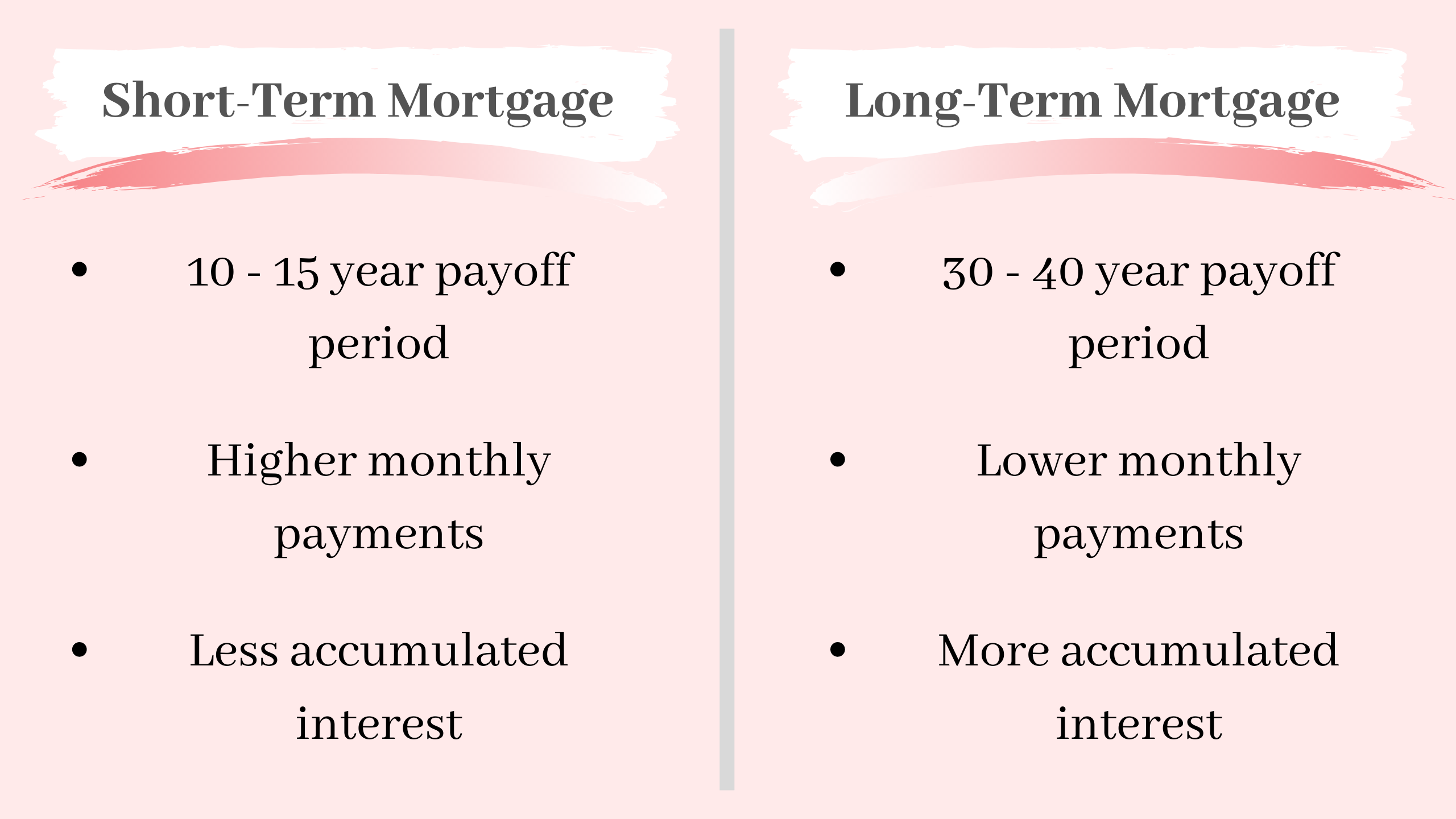

Next, let’s take a quick look at short-term versus long-term loans. These are much simpler to understand: It refers to how much time is set out for you to pay off your loan. Short term loans are typically over a period of ten or fifteen years. Long term loans are usually 30, but sometimes up to 40 years.

If you choose a shorter-term mortgage, your monthly payments will be higher. However, the longer your loan takes to pay off, the more interest you’ll accumulate as you do so. If you’re capable of paying off a short-term loan instead of a long-term one, you can save yourself hundreds of thousands of dollars in the end.

There you have it! Those are the basics of what a mortgage is. There are other types of mortgages, like government loans, and other factors that affect your mortgage, like the interest rates I mentioned above, but we’ll discuss those next time, when we talk about how to qualify for a mortgage. Come back next week if you want more answers on that!

For now, I hope this gave you an insight on how mortgages basically work, and made everything a little more clear. If you have more questions, you can also contact Megan Munley at Fairway Mortgage – she’s a great consultant who would be happy to answer your questions.

And remember, if you have more questions, feel free to call or email me and ask! My contact info is right in the top bar of the site – don’t hesitate to reach out if you want to know more. If you decide you’re ready to take the next steps and start officially looking for a house, I’m ready to help out and be your guide!