A week ago, we discussed and answered the question “What is a mortgage?” If you missed that post or want a quick refresher, click here to learn all about it. Now that we’ve got that all settled, let’s take a look at another, related question I get a lot: “How do I qualify for a mortgage?”

Let’s break that question down and answer it in simple terms first: Qualifying for a mortgage is basically determined by two factors: Your credit score, and your Debt-to-Income Ratio, or DTI.

As far as credit scores go, most lenders want to see a score of at least 640. However, some other types of loans, like government-backed loans, allow for lower scores, depending on the circumstances.

We’ll talk more about the different kinds of lenders later on.

For right now, let’s discuss that second factor.

DTI: Debt-to-Income Ratio

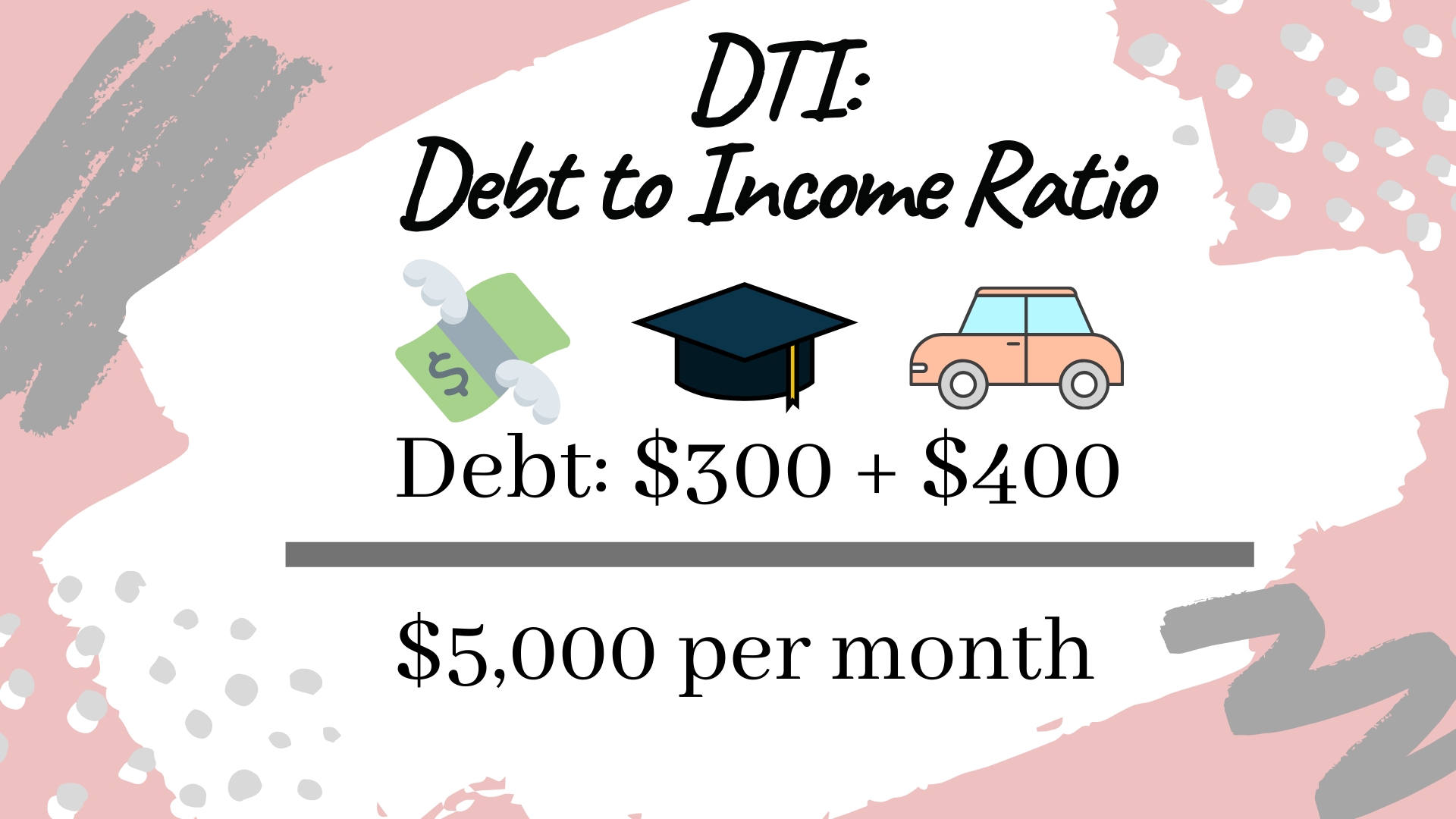

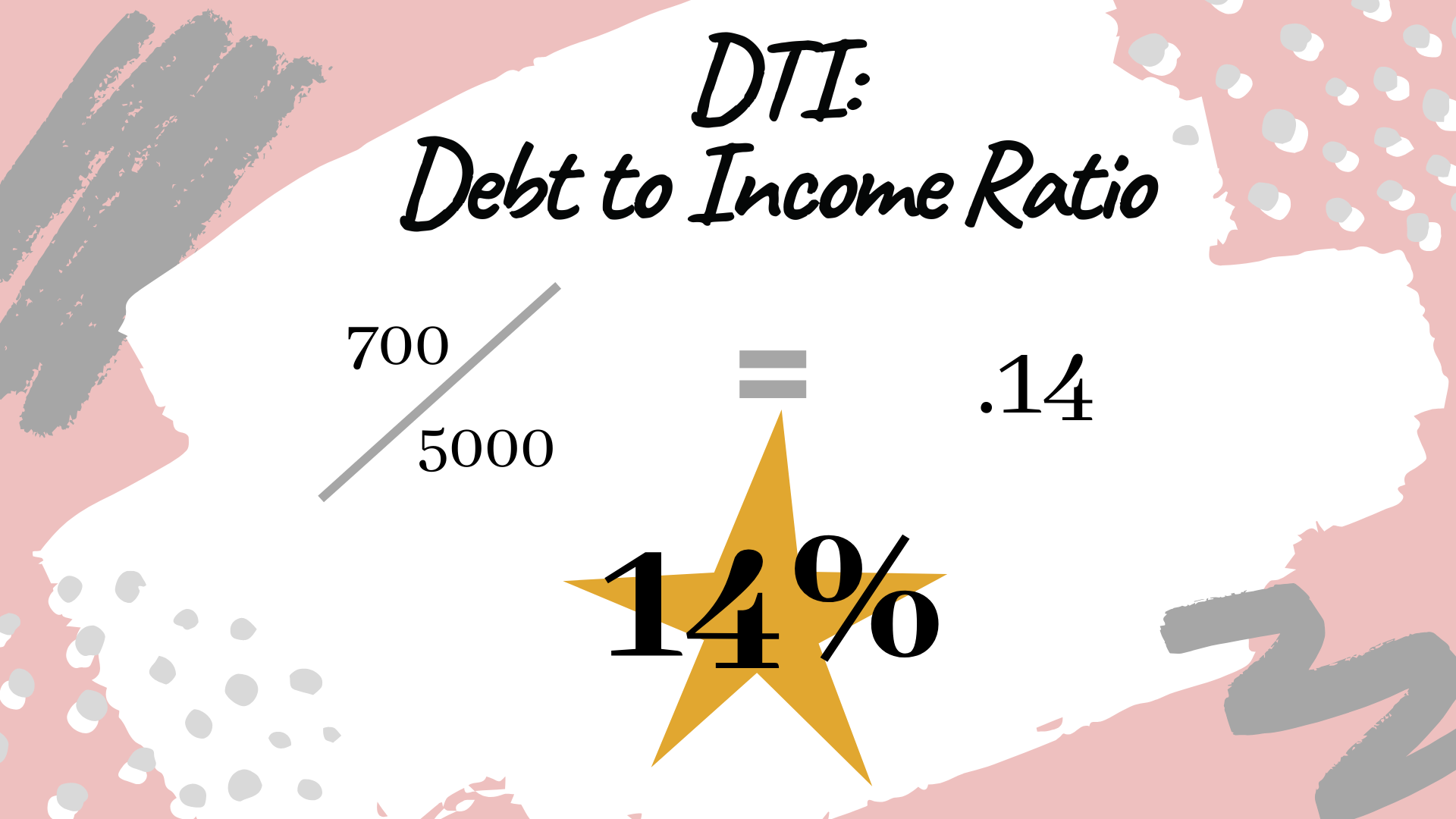

The way to determine your Debt to Income Ratio is by dividing your number of debt payments per month by your amount of income per month. For example, let’s say you have a $300 monthly student loan payment, a $400 monthly car loan payment, and you bring in $5000 per month. This would mean your DTI is 700/5000, which comes out to .14, or 14%.

This is a great DTI: You can have much bigger monthly debt payments than that and still qualify for a home loan. Typical lenders require a DTI of 40% or less. Some government loans will, however, make exceptions to the rule, and allow a DTI under 50%, if you have at least two months of reserves.

Reserves are simply any money or assets you may have that you could use as a backup to pay your debts if you fell on hard times. This could include money in savings accounts, investments, bonds, trusts accounts, the cash value of life insurance policies, or retirement account assets, to name a few.

Of course, lenders don’t only look at that information to approve or disapprove you for a loan. They will also want to know whether you have steady monthly income, and what it is—they’ll want to look at paystubs, W2s, tax returns and other documentation to verify.

This doesn’t mean you’ll be less likely to qualify for a mortgage if you frequently change jobs or have an unconventional income source—you just have to prove that whatever amount you earn is stable and predictable.

Other Factors in Qualifying for a Mortgage

Down Payments

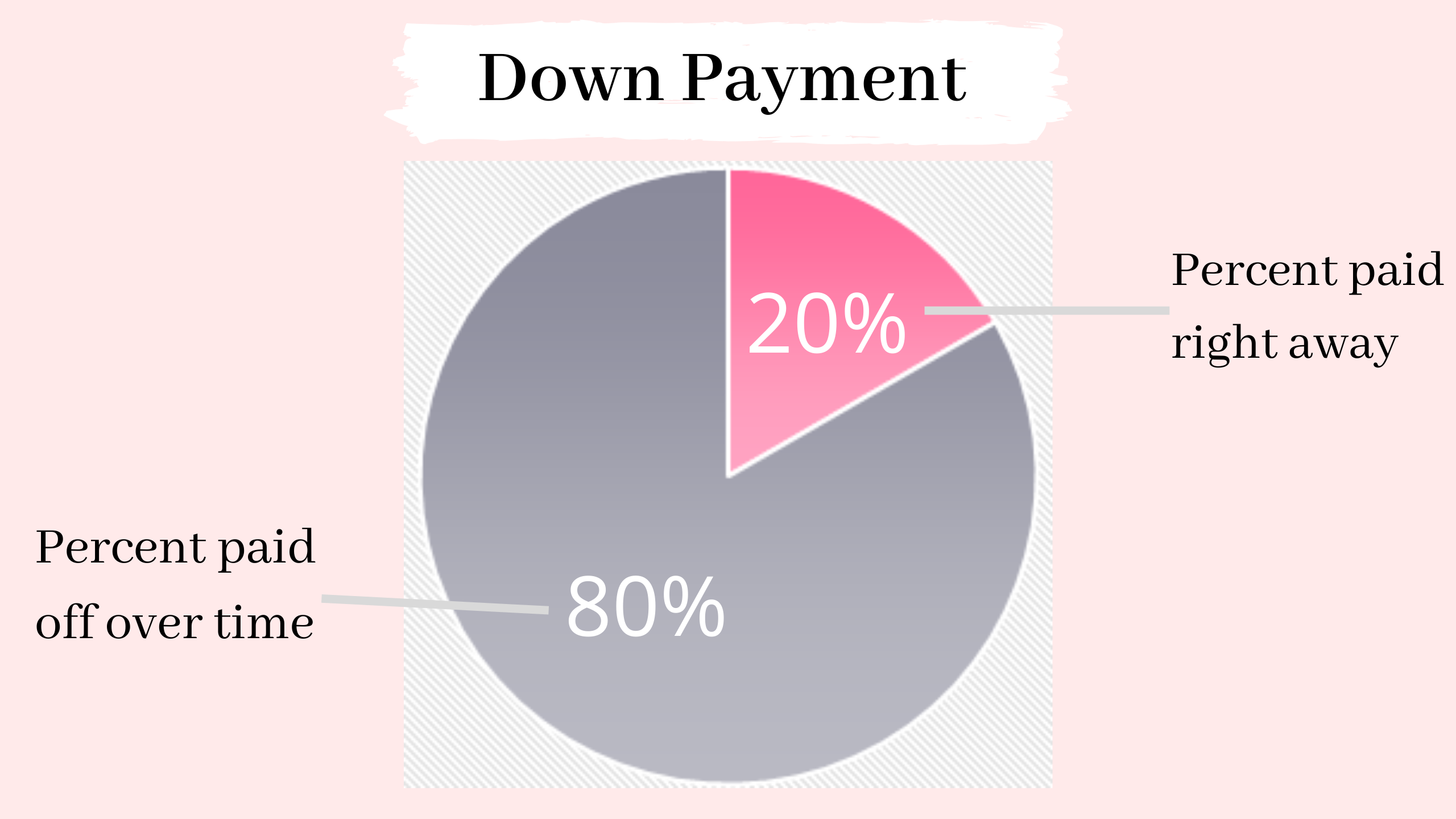

One last thing you’ll need to have is a down payment. Down payments are typically around 20% of the loan.

This is why people talk about needing to save up to buy a house—even with a loan, you have to put down a significant chunk of change upfront to purchase your home. Basically, whatever price range you want to buy in, you’ll ideally want to have saved a fifth of the cost first.

There are, however, other ways to pay less on a down payment. Conventional loans now offer 3% down programs, if you pay for Private Mortgage Insurance along with the loan. PMI can be paid for monthly, upfront, or a combination of the two. If you have trouble scraping together 20% of the cost of your home, but still know you’d be able to pay for it eventually, these programs are something to consider.

There are also, as we mentioned before, other types of loans, that typically require less of a down payment from the get go—let’s talk about those now.

Other Types of Loans

Up until this point, we’ve been talking mainly about conventional loans. These are loans that are not backed by the government, but adhere to standards set by Fannie Mae and Freddie Mac, which are large national loan programs. These loans are typically the best option for those with higher credit scores and stable income, because they usually result in the lowest monthly payments.

However, Government-backed loans are loans many people often go with, for a variety of reasons. One of those reasons has to do with the down payment issue we were just discussing: government-backed FHA loans often only want 3.5% as a down payment, and some special government loans may not require a down payment at all—like those offered by the US Department of Veterans affairs to military families, or by the US Department of Agriculture for some who live in rural areas.

Depending on where you live, what your profession is, and how steady your income is, these loans might be a more viable option for you. If you’re unsure, it’s worth looking into your options.

Closing Costs

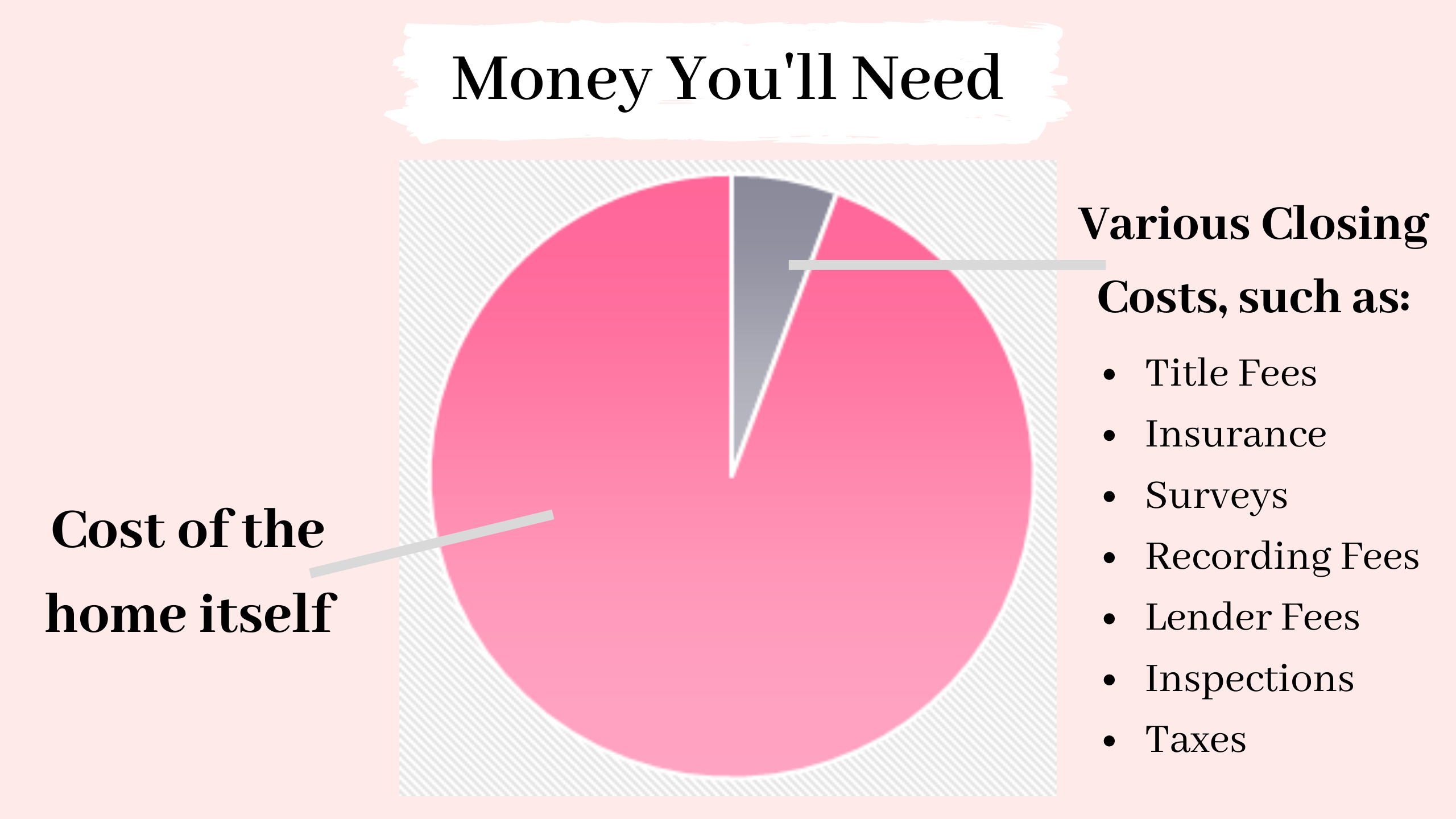

Another thing to keep in mind: The cost of the house and the interest on the loan aren’t the only costs involved with buying a home. Something you’ll hear quite a bit of in the homebuying process is the term “Closing Costs.”

This term refers to any expenses involved in the transactional process of the sale of a home, like title fees, title insurance, surveys, recording fees, and other things. One of those things that is directly related to mortgages is points—that’s money paid to your lender in exchange for a lower interest rate.

Closing costs often make up about 5-7% of a home’s total value, so on a $300,000 home, closing costs could be anything from $15,000-$21,000. That’s definitely something you should be careful of when choosing a home to buy.

“When will I be completely, officially qualified for a mortgage?”

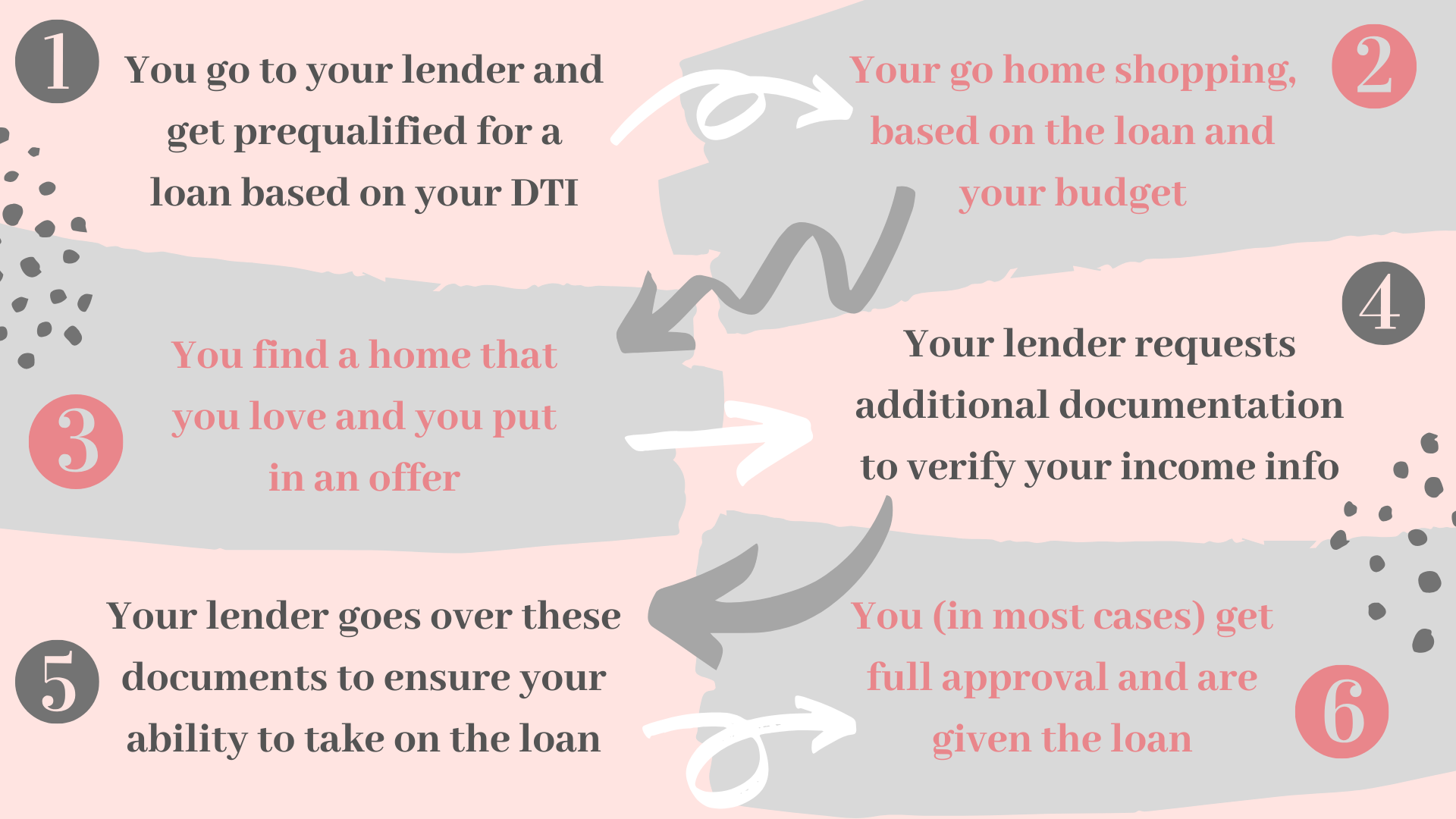

One last thing you need to know about when trying to qualify for a mortgage is the timeline, because this is important: You can go to a bank and get prequalified for a loan up to a certain amount, based on your debt and income, before you go shopping or pick out a home to buy, but this pre-approval does not automatically mean you’ll be approved for the mortgage once you pick out the house.

It’s only after you find a home and make an offer that your lender will request those additional documents that we mentioned earlier, like W2s and tax returns. Once your lender looks at those you can get full approval. Most prequalified buyers will get the mortgage they request, but 1 in 10 don’t.

If qualifying for a mortgage based on those documents is something that makes you nervous, you can ask your loan officer if you can get a full-credit approval beforehand. This allows an underwriter—the final decision maker in the loan approval process—to look at your assets, documentation, and credit history, and determine from the get go whether you will be allowed to take out the loan. This process does require more verification, and therefore more work and time, so only plan to undertake it if you are truly worried that your debt, income, and salary information will not be enough to get you approved.

And that’s all there is to it! I hope this answered any and all questions you had about the basics of qualifying for a mortgage. If you want more info, or are looking to see if you can qualify for one yourself, I’d like to once again recommend that you contact Megan Munley at Fairway Independent Mortgage. She’s a fantastic and mortgage officer who would be happy to help you and answer any other questions you might have.

And, of course, if after reading this you feel like you’re ready to take the leap and start shopping around for homes, I’d love to be your realtor. You can contact me over phone or email: All of my information is located at the top of the site, or, if you’re on mobile, in the sidebar menu to your right.

Until next week, everybody! Make sure you check back in, especially if you’re in the early stages of your home-buying process: Next week we’ll be discussing how to determine how much house you can afford.

Thanks for reading!