There’s a lot of talk these days about how ,illennials don’t want to buy homes, but that’s simply not true. Millennials are in the perfect age and position to buy homes – now more than ever, as interest rates are ridiculously low. It seems, though, that fewer of them are buying than their parents… and thanks Abby Stiller of Remax in Florida, and the 2020 Millennial Home Buyer Report, we may know just why: It’s because of two commonly circulated homebuying myths.

The 2020 Millennial Home Buyer Report shows how this generation is not really any different from previous ones when it comes to homeownership goals:

“The majority of millennials not only want to own a home, but 84% of millennials in 2019 considered it a major part of the American Dream.”

Unfortunately, the myths surrounding the barriers to homeownership – especially those related to down payments and FICO® scores – might be keeping many buyers out of the arena. The piece also reveals:

“Millennials have to navigate a lot of obstacles to be able to own a home. According to our 2020 survey, saving for a down payment is the biggest barrier for 50% of millennials.”

Millennial or not, unpacking two of the biggest homebuying myths that may be standing in the way of across all generations is a great place to start the debunking process.

Homebuying Myth #1: You need a 20% down payment.

We also talked about this in our post on mortgages: While it’s the standard loan that you should have 20%, or about one fifth, of the cost of the house you want before you consider buying. Since this would be an insurmountable barrier for so many young millennials, many have written it off their lists. It’s not true, though.

Many buyers often overestimate what they need to qualify for a home loan, making this one of the most deflating homebuying myths out there. According to the same article:

“A down payment of 20% for a home of that price [$210,000] would be about $42,000; only about 30% of the millennials in our survey have enough in savings to cover that, not to mention the additional closing costs.”

While many potential buyers still think they need to put at least 20% down for the home of their dreams, they often don’t realize how many assistance programs are available with as little as 3% down. With a bit of research, many renters may be able to enter the housing market sooner than they ever imagined.

Homebuying Myth #2: You need a credit score of 780 or higher.

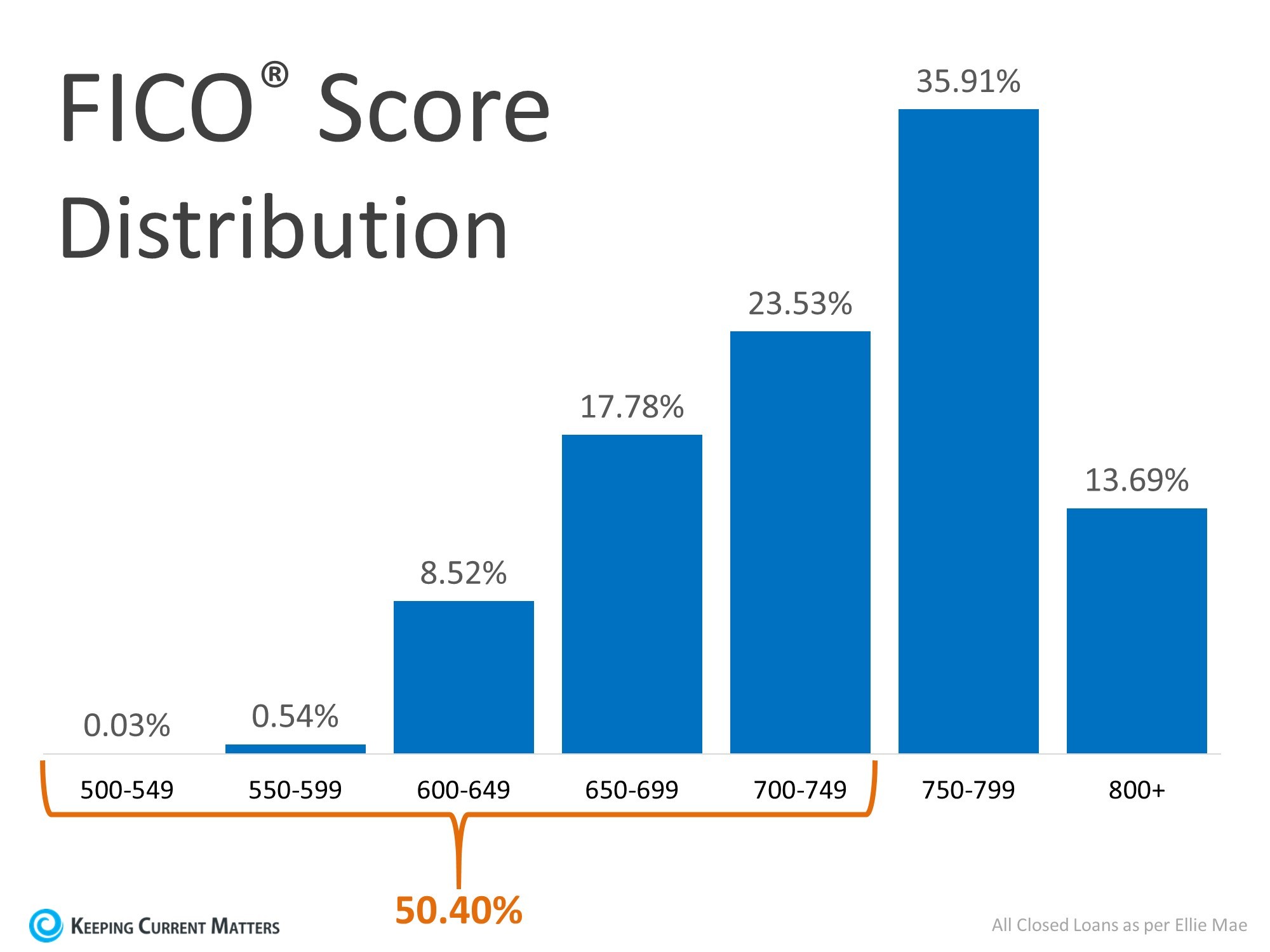

In addition to down payments, buyers are also often confused about the FICO® score it takes to qualify for a mortgage: Another very common homebuying myth has potential buyers believing they need a credit score of 780 or higher.

Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans, shows the truth of the matter, which is that over 50% of approved loans were granted with a FICO® score below 750 (see graph above). So don’t let a less-than-excellent credit score keep you from looking for the home of your dreams!

The Bottom Line

Even today, with all of the ease of access to information that the internet provides, many of the falsest and most discouraging homebuying myths are unfortunately still in circulation, keeping plenty of motivated buyers on the sidelines. In reality, it really doesn’t have to be that way.

If you’re thinking of buying a home, you may have more options than you think, especially with the low home interest rates! If you have more questions about these myths, or any other hesitation you may be feeling – or if you now feel you’re ready to buy – please don’t hesitate to reach out to me! Give me a call or send an email: I’d be happy to assist you get into a Paoli home, a house on the Main Line, or any other suburban Philadelphia home, in any way that I can.